#Contractor expenses for auto and travel code

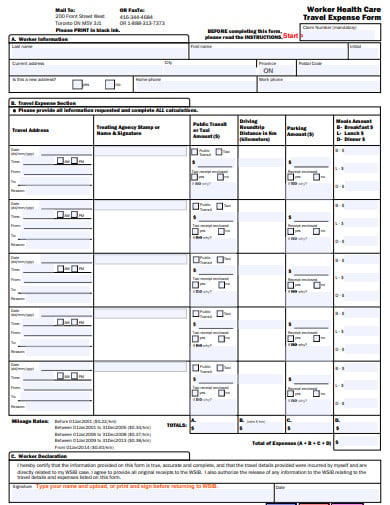

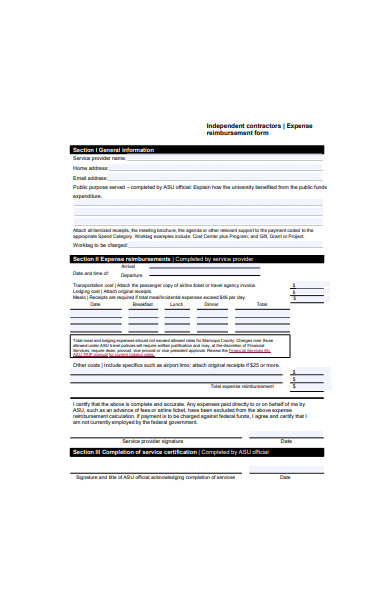

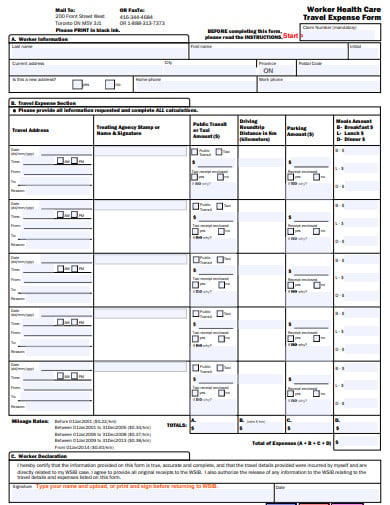

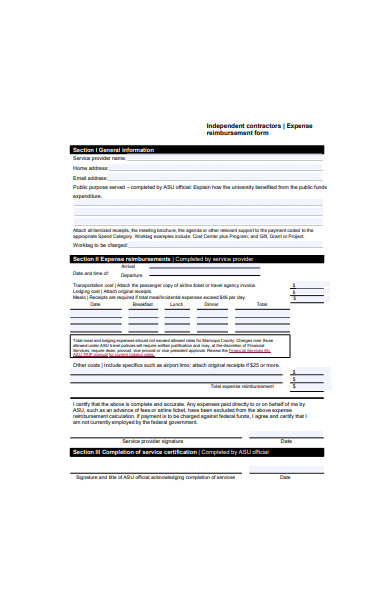

Code cities: See RCW 35A.13.040 (council-manager form) and RCW 35A.12.070 (mayor-council form) for reimbursement of councilmembers and mayors. In addition, there are several other statutes that apply only to specific agencies or officials. RCW 42.24.090 is the general statute authorizing reimbursement of expenses incurred by “officers and employees of any municipal corporation and subdivision of the state.” That statute also allows for other reimbursements in lieu of actual expenses incurred (such as per diems, mileage reimbursements for use of a personal vehicle, or hourly or monthly allowances or other basis that the legislative body determines to be proper). Practice Tip: Help your elected officials avoid embarrassment by coaching newly elected officials about your travel and expense reimbursement policy and answering any questions they may have. Sometimes travel and expense reimbursement policies are adopted as stand-alone documents, while other times they may be incorporated into other local policies such as a personnel policy or elected officials’ handbook. To address these various situations, the agency should have appropriate policies in place. In other cases, the employee may incur the expenses out-of-pocket and seek reimbursement from the local agency. In some instances the local agency may pay for these expenses through a centralized procurement/accounts payable system, advanced travel imprest accounts, or the use of a government-issued credit card.

(For simplicity’s sake, we will refer to all of these employees, elected officials, etc.

It is common for local government employees, elected and appointed officials, and others (such as advisory board members or volunteers) to incur business and travel-related expenses in their official capacity working on behalf of the jurisdiction.

0 kommentar(er)

0 kommentar(er)